Birth Producers Gardner loans Was Diverse

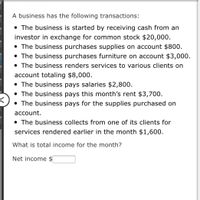

One of many almost 176,100 in debt birth facilities (Desk step one), there was nice variability in the farm proportions and you may construction, generating variations in borrowing means and you will risk users. Particularly, a start-up work by a single person in addition to their partner will get other borrowing means than simply some body trying to enter into a reputable industrial agriculture process.

- Farms in which the no. 1 operator was an orifice farmer additionally the farm is operated from the a single operator or an operator and companion having,

- Below $a hundred,000 inside yearly ranch design, and you will

- $100,100 or more within the annual farm creation.

- Farms which have a couple of operators, leaving out spouses, in which one agent was a beginning character in which:

- Operators was indeed multiple-generational, in which 25 or higher many years broke up age first character and also at the very least another driver, and you can

- Another facilities having numerous workers.

And additionally a great many other standards (USDA-FSA, 2012), an experienced candidate need certainly to . significantly be involved in the newest procedure, leaving out of a lot second and you can tertiary providers away from qualification. Yet not, secondary and you will tertiary operators is eligible as co-candidates out-of an agriculture entity, offered an important user together with is applicable and that’s eligible. Secondary and you may tertiary workers also can incorporate as someone, provided it create a business package appearing an aspect of an effective agriculture company in which they are the top vendor from work and you may government.

The smaller, more traditional ranch, operate from the a single operator and a partner, however signifies the preferred delivery ranch. Above half of (59%) away from in debt beginning farms, got less than $one hundred,100000 in the yearly farm manufacturing and were operated by a single user otherwise single driver that have a girlfriend (Dining table 1). If you are symbolizing a lot of every in debt beginning farms, only one-last of the many birth ranch debt is due by this classification, most of which was a home debt. On average, brief, unmarried operator facilities are not profitable and you will, consequently, count heavily into low-farm sourced elements of income. Further, once the farming might so much more focused, reduced facilities now account for a little express of your worth out-of U.S. farm development. When you are representing 76% of complete farms, farms having below $100,000 when you look at the production discussed less than 5% of your total property value U.S. farm production within the 2014. Because of low production and large money standards, it might be difficult for most of these short-scale operations are economically alternative, as well as those with delivery growers. Averages is disguise effective small facilities, not. On the other hand, brief facilities complete shall be vital that you the newest rural cost savings. Because they portray a life threatening share of your own complete ranch people, brief birth facilities have impacts toward economic activity, particularly in alot more rural components. More over, they are important in specific markets niches, for example apiculture, organic make, pick-your-individual, otherwise society-supported-farming (Newton, 2014). Due to the fact to acquire a little farm signifies a feasible and preferred means for an orifice character to get in farming, interest in birth farmer money from this category might will still be strong.

Including, its borrowing means was in fact way more varied with a more impressive express away from borrowing from the bank being used to finance working-capital and other non-a home need

As compared to shorter facilities, borrowing from the bank is much more crucial that you facilities which have $a hundred,one hundred thousand or higher into the farm manufacturing operated by an individual user and their partner. If you are symbolizing 21% of all in debt birth facilities (Desk step one), this group held more a 3rd of the many beginning farm financial obligation and had the typical financial obligation-investment ratio out of 30.5%. Beginning producers in this proportions group were more dependent towards the farm business, having ranch earnings accounting for more than 50 % of their family income.

0 thoughts on “The latter dos organizations included second and tertiary farm workers, who are not explicitly entitled to FSA money”