Contents:

However, the level of sophistication of the computer program should not really concern the majority of users as they come to the Forex market to make money, not to spend it. Most trustworthy brokers came up with the most optimal solution – they purchase the original version of the trading platform software along with a right to share access to it. This way, by signing up with the right broker, we can also get access to the most modern and effective trading platforms at no charge. Additionally, the broker would normally also take care of the familiarization process by providing handy studying materials on how to install and use the platform. By drawing this fan, you can easier visualize the potential points of resistance and support and plan your next moves accordingly. This type of implementing Fibonacci sequence in trading is mostly used by long term traders, who want to see a bigger picture starting from an existing trend.

- When entering a sell position near the top of the large move, you can use the Fibonacci retracement levels as profit-taking targets.

- The pre-established selection of Fibonacci tools will allow you to effortlessly achieve the necessary results with just a few clicks.

- For some reason, these ratios seem to play an important role in the financial markets, just as they do in nature.

Fibonacci retracement levels are drawn by identifying the high and low points of a price move and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%. In this article, we will explain how to draw Fibonacci properly in forex. Fibonacci retracement is a popular tool that technical traders use to help identify strategic places for transactions, stop losses or target prices to help traders get in at a good price. The main idea behind the tool is the support and resistance values for a currency pair trend at which the most important breaks or bounces can appear.

What is a rollover in forex?

They rely on graphs and charts to plot this information and identify repeating patterns as a means to signal future buy and sell opportunities. When prices are trending upwards and you hold a long position, one consideration is to place the stop loss just below the latest swing low rate. Because the swing low rate sometimes becomes a level of support, a falling price may recover before it actually falls through a previous support level. Fibonacci retracement levels are considered a predictive technical indicator since they attempt to identify where price may be in the future. The 23.6% level is considered to be the first level of support or resistance, while the 38.2% level is the second level of support or resistance.

For example, if the https://traderoom.info/ retraces to the 50% level and then bounces higher, this could be a signal to buy. On the other hand, if the price retraces to the 61.8% level and then resumes its downtrend, this could be a signal to sell. If you are thinking of adding the Fibonacci’s math into your trading strategy, there are two main things you can do. You can choose to use a predetermined strategy that has been designed around any of the Fibonacci tools or methods. Or you can use the described above tools to combine them with other methods and indicators and support your previously calculated opinions. Before we go further, it is important to note that all of the above Fibonacci methods, including the retracements, the projections and the fans have to be calculated in relation to a trend.

How Does Fibonacci Work In Trading?

One of the most popular confirmation tools that can help identify whether the price of a market may turn or not is price action analysis. This is the study of candlestick or bar formations on the chart and there are a variety of price action trading patterns traders can choose from. If Fibonacci retracement levels give us the area to buy or sell, then price action trading patterns can help us time when to buy or sell. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels.

The four listed in the diagrams above are the most commonly used Fibonacci retracement levels. Traders use the Fibonacci extension levels as potential support and resistance areas to set profit targets. Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. The golden ratio is frequently used by traders and technical analysts, who use it to forecast market-driven price movements.

Fibonacci Trading Software and Fibonacci Retracement Indicators

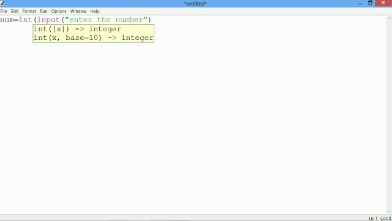

Based on the above criteria as well as a few others, we became faithful supporters of the Metatrader 4 trading platform. MT4 combines complex algorithms with user-friendly design effortlessly and makes online currency trading accessible to absolutely anyone, no matter what their level of computer knowledge is. The currency trading itself is a complex matter with many steps to it. However, this does not mean that the tools used in the process need to be complicated as well. Even the most highly functioning and sophisticated platform has to be easy to read and comprehend for all categories of traders. And it is also important to have an option to sort out and customize the platform features to your liking to make the analysis and trading as fast and as simple as possible.

BTCUSD Technical Analysis – ForexLive

BTCUSD Technical Analysis.

Posted: Thu, 20 Apr 2023 09:16:00 GMT [source]

The retracement concept is used in many indicators such as Tirone levels, Gartley patterns, Elliott Wave theory, and more. After a significant movement in price the new support and resistance levels are often at these lines. In conclusion, the Fibonacci scale is a useful tool for forex traders looking to identify potential support and resistance levels in the market.

One way could be to wait for price to retrace to a 1.618 extension level and look for signals that tells you price can start to continue in the underlying trend on a larger timeframe. The first step is to identify the high and low points of a price movement. This can be done by looking at a chart of the currency pair and finding the highest and lowest price points over a given period of time. ActionForex.com was set up back in 2004 with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Because of all the people who use the Fibonacci tool, those levels become self-fulfilling support and resistance levels.

Identify bearish price action trading pattern, such as the ‘shooting star’ pattern at one of the Fibonacci retracement levels. Identify bullish price action trading pattern, such as the ‘hammer’ pattern at one of the Fibonacci retracement levels. An example of the MetaTrader 5 trading platform provided by Admirals showing Fibonacci retracement levels drawn on using the Fibonacci retracement tool in a downtrend. An example of the MetaTrader 5 trading platform provided by Admirals showing Fibonacci retracement levels drawn on using the Fibonacci retracement tool in an uptrend. There are also other Fibonacci trading ratios that traders use such as 23.6% and 78.6%, among others.

And to go short on a retracement at a Fibonacci resistance level when the market is trending DOWN. Then, figure out the highest and lowest swings in the chart formation. How to Double your Small ($250) Trading Account Trading Bitcoin I started a degen account with $250 and almost doubled it in 4 days making about 6 trades. This strategy is not Financial advice and I’m only illustrating what I have learnt trading this way. This is the first video in the series and I’ll be continuing the series , updating you on progress, winners,… Gold is a precious metal trading derivative product originated in London, but it has now become popular worldwide.

This article will provide you with all of the benefits of using a demo account in Forex trading. Very often, the main supporting level on the Fibonacci Fan is the 61.8%. By applying the following rule, we might have a good chance for an entry purely based on Fibonacci Fan trading. Fibonacci Fan is the default indicator on MetaTrader 4 and MetaTrader 5 , and you can assess it directly. Once the price breaks the 38.2% level, it will usually go to the 61.8% level.

Fibonacci retracements are a popular technical analysis tool used by forex traders to identify possible support and resistance levels in a market. These levels are based on the fibonacci sequence and are calculated by dividing the distance between high and low points by key ratios of the sequence. Traders can use fibonacci retracements to identify potential entry and exit points based on the price movement of a currency pair. Fibonacci retracements are not a foolproof trading strategy, but they can be a useful tool in a trader’s toolbox.

Almost all fibonacci analysis forex have a trading style or set of strategies they utilize in order to maximize profit potential and keep their emotions in check. The Fibonacci trading strategy utilizes hard data and if a trader adheres to their strategy, there should be minimal emotional interference. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. If they were that simple, traders would always place their orders at Fibonacci retracement levels and the markets would trend forever.

How long into london forex session are patters established?

These lines anticipate the support and resistance levels, as well as trading ranges. For example, it was commonly believed the .618 retracement would contain countertrend swings in a strongly trending market. That level is now routinely violated, with the .786 retracement offering strong support or resistance, depending on the direction of the primary trend. Traders and market timers have adapted to this slow evolution, altering strategies to accommodate a higher frequency of whipsaws and violations. 12th-century monk and mathematician, Leonardo de Pisa discovered a numerical sequence that appears throughout nature and in classic works of art.

- Next, add grids at shorter and shorter time intervals, looking for convergencebetween key harmonic levels.

- If you are trading using the Bollinger Bands, for example, they appear on the chart based on the automatized calculations.

- Reversal traders may also use the 161.8% level to enter into counter-trend trades but this is more suited to advanced traders.

- This methodology applies to exits as well, telling forex traders to take profits when price reaches a retracement level that shows multiple alignments.

- The key levels to watch are the 50% and 61.8% levels, which are considered to be strong support and resistance levels.

Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child. Therefore, these events signaled that the Fed was nearing the end of its tightening cycle, which pushed traders to embrace a risk-on sentiment. If you had some orders either at the 38.2% or 50.0% levels, you would’ve made some mad pips on that trade.

For some reason, these ratios seem to play an important role in the financial markets, just as they do in nature. The fans are a charting technique consisting of diagonal lines that use these ratios to help identify key levels of support and resistance. They can be used to determine critical points that cause a price to reverse. Nowadays, Fibonacci levels are used in all types of trading including stocks, futures, commodities, cryptocurrencies, and also Forex trading.

As we have previously discussed above, the Fibonacci fan can be built both manually and automatically and appears in a form of three diagonal rays, going in the same direction as the trend. The fan is a great tool for dynamic stop losses – you can simply adjust parameters of your stop loss in accordance with the fan line, until you get the satisfactory result. When using this tool, pay close attention to the location of the fan, as it depends on whether the trend is upward or downward. Jitanchandra is a financial markets author with more than 15 years experience trading currencies, indices and US equities. After a big fall in price, traders will measure the move from top to bottom to find where price could retrace to before correcting lower and continuing in the overall trend lower.

Leonardo Fibonacci was an Italian mathematician who first observed certain ratios of a number series which can describe the natural proportions of things in the universe. Price pulled back right through the 23.6% level and continued to shoot down over the next couple of weeks. One of the most effective ways of using them is to determine the extent of a pullback. Due to its characteristics, one can estimate if a pullback will be a mere Fibonacci retracement, or will it turn into a reversal of the existing trend.

These secondary ratios have taken on greater importance since the 1990s, due to the deconstruction of technical analysis formula by funds looking to trap traders using those criteria. As a result, whipsaws through primary Fibonacci levels have increased, but harmonic structures have remained intact. Traders can use the extension levels as an area to focus on for a target area.

Fundamental Analysis

The presentation starts with a short power point of Fibonacci and how Phil uses them as well as the strategy outline. Have you ever wondered why price action sometimes forms a bull flag pattern? Have you ever wondered if there is a way to predict whether a bull flag will break out before it actually does so?

GBPJPY Meets Upper Border of Ascending Channel – Action Forex

GBPJPY Meets Upper Border of Ascending Channel.

Posted: Thu, 20 Apr 2023 08:14:14 GMT [source]

From that point on, the Arabic numeral system got a strong foothold in the European community and soon became the dominant method of mathematics in the region and eventually throughout the world. It was so strong that we still use the Arabic numeral system to this day. Targets are placed at Admiral Pivots, while the stop-loss is placed below the last swing low and above the previous swing high . Possibly the strongest S/R level that marks the end of a correction, a price reversal, and the change of the trend. If, for example, the pattern point 3 equals or is close to 61.8 of 1-2 retracement, the FE 100 should be a strong S/R level. Enter some of these levels manually within the indicator properties.

If the market bounces off a Fibonacci level, it is considered to be a sign of support or resistance. Traders may then enter a trade in the direction of the trend, with a stop loss placed below the Fibonacci level. Unlike moving averages, Fibonacci retracement levels are static prices.

ETHUSD Pulls Back Aggressively from 11-month pPeak – Action Forex

ETHUSD Pulls Back Aggressively from 11-month pPeak.

Posted: Thu, 20 Apr 2023 10:15:09 GMT [source]

This will help to reduce the risk of false signals and increase the chances of a successful trade. Forex market technical analysis focuses primarily on the charts themselves. Forex traders often make the mistake of relying solely on Fibonacci levels to take positions in the market but this can be detrimental as this can make them too one dimensional. Additional support from other indicators, chart patterns, candlestick patterns and fundamentals are essential to formulate a better overall strategy; and ultimately a well-informed trade decision. The Fibonacci can be an extremely powerful tool in forex trading so fully understanding its foundations can be beneficial to any trader looking to implement the tool within their trading strategy.

0 thoughts on “Technical Tools for Traders Fibonacci Fibonacci Retracement Lines OANDA”